florida estate tax filing requirements

If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. Be sure to file the following.

Florida Inheritance Tax And Estate Tax Explained Alper Law

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

. Application for a Florida Certificate of Forwarding Agent Address. If you live in the state of Florida or have assets in the state of Florida I have some good news for you. One of the most important steps is to make.

PDF 220KB Fillable PDF 220KB DR-1FA. Additionally counties are able to levy local taxes on top of the state. Florida estate tax due.

Application for Consolidated Sales and Use Tax Filing Number. Florida does not have an inheritance tax so Floridas inheritance tax rate is. Note that simplified valuation provisions apply for those estates without a filing requirement.

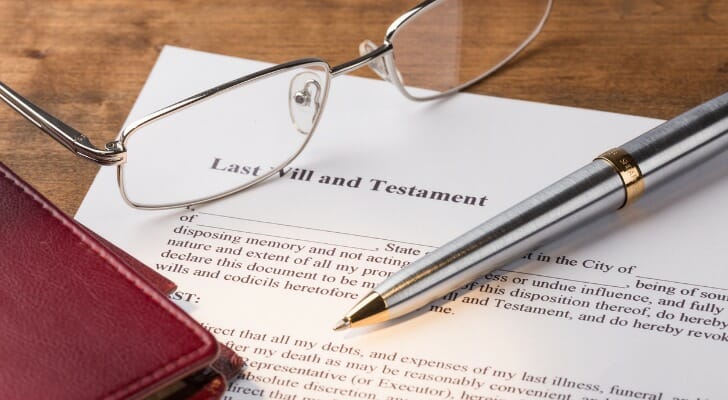

The estates executor is also responsible for filing the decedents final income tax return and taking care of any other tax obligations. If the death occurs on or after January 1 2000 but before January 1 2005 the personal representative must comply with the two requirements listed above and. Florida is one of 38 states that does not.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine. The types of taxes a deceased taxpayers estate can owe.

As a result of recent tax law changes only those who die in 2019 with. In Florida theres no state-level death tax or inheritance tax but there is still a federal estate tax requirement so if an estate is valued at more than 11 million there is a potential federal. This election is made on a timely filed estate tax return for the decedent with a surviving spouse.

Executors duties in Florida include taking control of the decedents. Executors must be over 18 and capable of performing the duties. An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person.

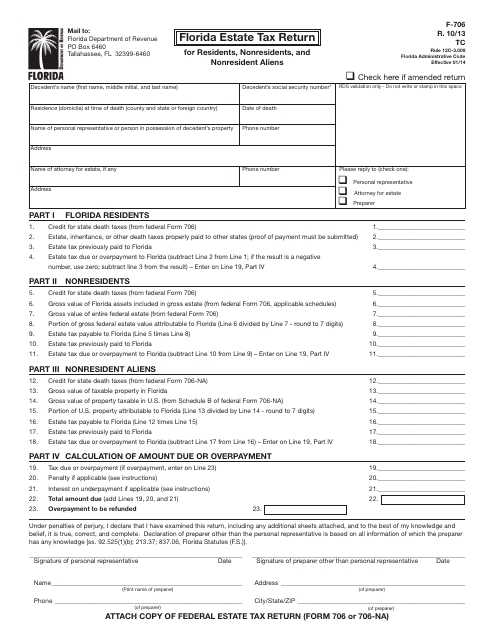

If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. There is no Florida estate tax.

You are a new Florida corporation and your tax preparer filed Florida Tentative IncomeFranchise Tax Return and Application for Extension of Time to File Return Form F. Floridas general state sales tax rate is 6 with the following exceptions. If the estate produces income or reaches the threshold to activate federal estate taxes the personal representative may have to file taxes on behalf of.

File Taxes When Required. No Florida estate tax is due for decedents who died on or after January 1 2005. Tax-exempt organizations that have unrelated trade or business income for federal income tax purposes are subject to Florida corporate income tax and must file either the Florida Corporate.

Executors administer an estate under a valid will.

New Irs Requirements To Request Estate Closing Letter

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

What Is An Estate Tax Napkin Finance

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Deadline Extension What Is And Isn T Extended Smartasset

Form F 706 Download Printable Pdf Or Fill Online Florida Estate Tax Return For Residents Nonresidents And Nonresident Aliens Florida Templateroller

Florida Inheritance Laws What You Should Know Smartasset

Ballot Initiative Homestead Property Tax Exemptions For Teachers Cops Others But At What Cost Florida Phoenix

Florida Property Tax H R Block

Estate Planning Vero Beach Lawyer Vero Beach Attorney Jennifer D Peshke

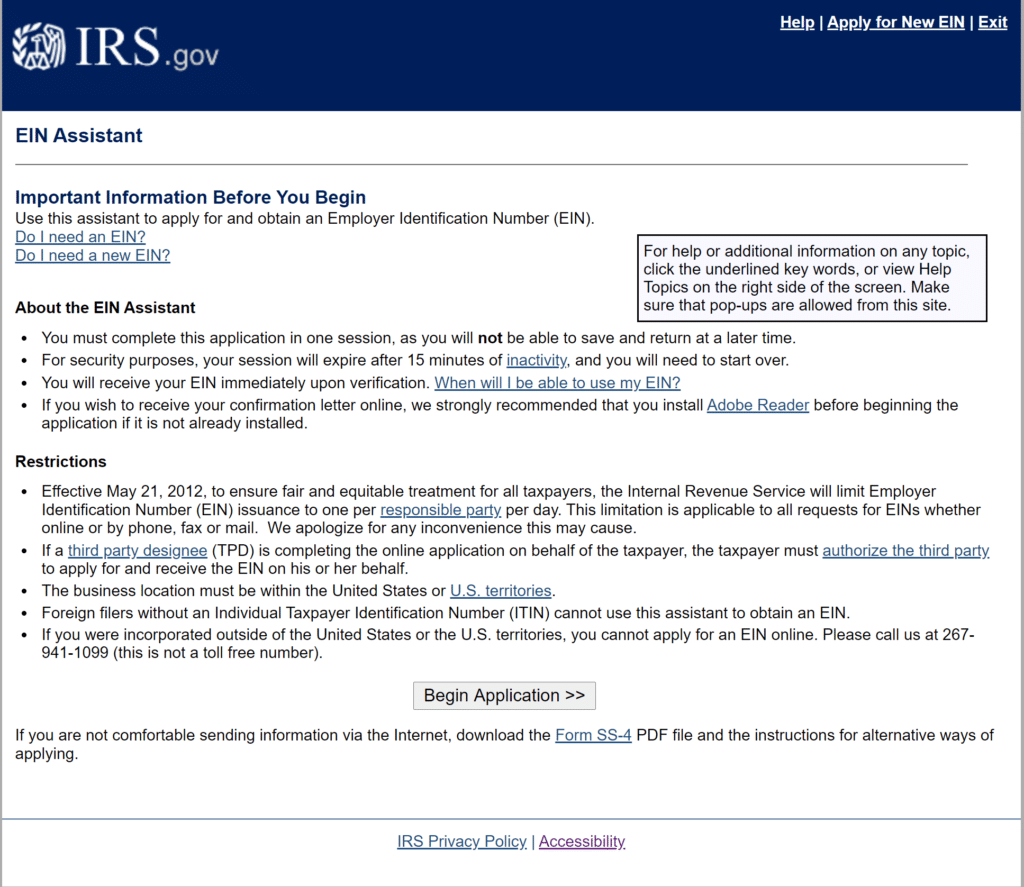

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Notice Of Federal Estate Tax Return Due P 3 0950 Pdf Fpdf Doc Docx

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

What You Need To Know About Estate Tax In Fl

5 Great Florida Property Tax Appeals Numbers And Dates South Florida Law Pllc